Banco Ita Chile Case Study Highlights SWIFT Code Necessity

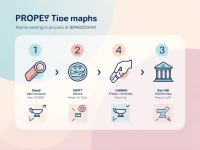

The SWIFT code ITAUCLRMSSO of Itau Bank is crucial for cross-border remittances. This article provides detailed information about the bank and how to properly use the SWIFT code to ensure safety and smoothness in international transfers. Additionally, it advises on paying attention to fees and exchange rate fluctuations when making remittances.